The Taxation of Internet Connectivity Services in Uganda: How Tax Policy Compounds the Cost

By Denis Yekoyasi Kakembo, Bill Page, John Teira, Dickens Asiimwe Katta, Francis Tumwesige Ateenyi

1. Introduction

Despite the government’s expression in the National Broadband Policy of its understanding of the importance of internet connectivity as a critical factor of production essential for business continuity, healthcare, education, and government services, there is a disconnect between this aspiration and the country’s tax policy in relation to internet connectivity.

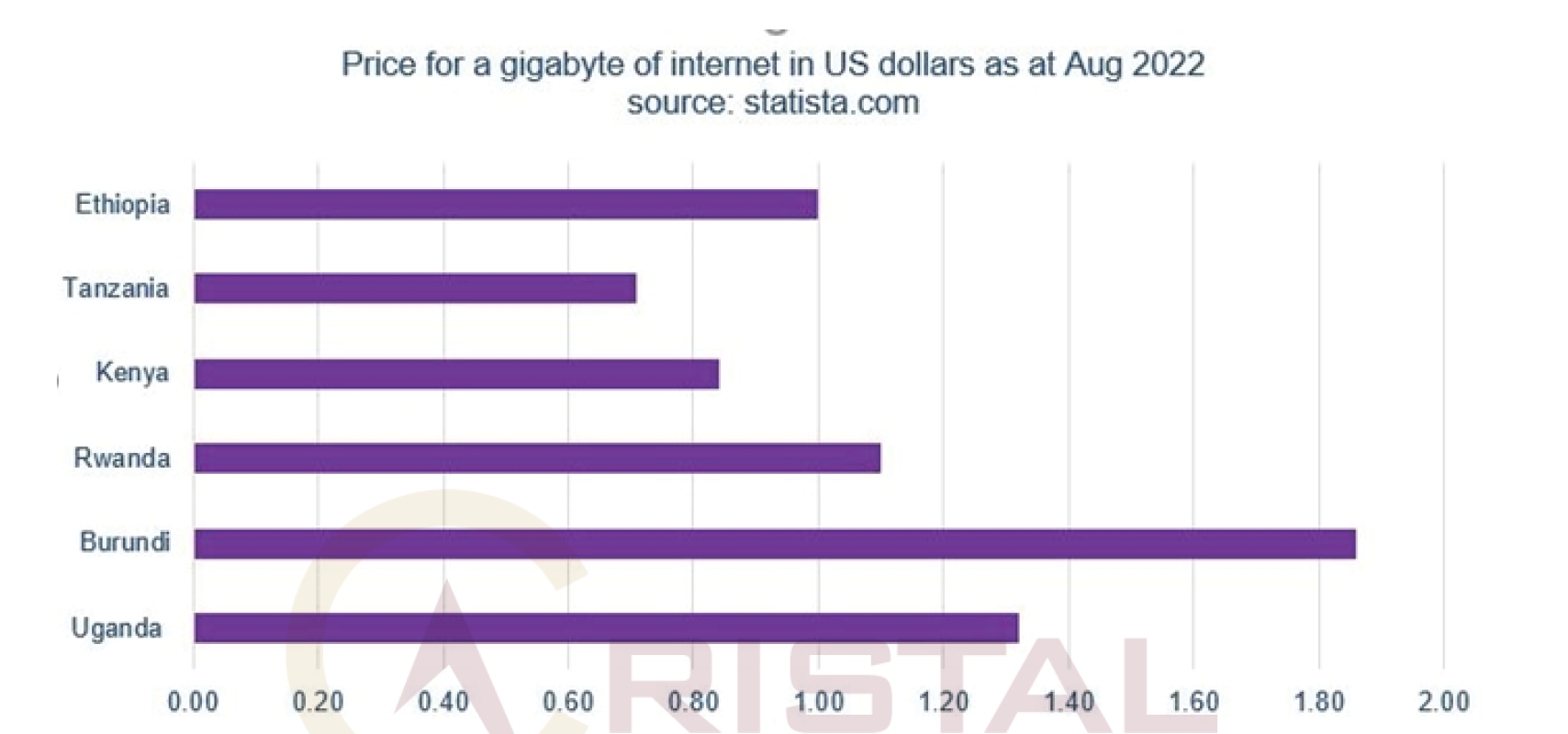

As illustrated below, Uganda has one of the highest cost of internet in the region largely attributed to high taxation. As we set out in this publication, it is time for the government to re-examine its policy stance on the taxation of internet connectivity services in Uganda to make it more affordable.

2. Imported internet

Prior to selling internet connectivity services to customers in Uganda, the Internet Service Providers (“ISPs”) import the same either via satellites or fibre optics. As we expound further in this article, at this point of importation of this internet by the ISPs, there is imposed a tax known as reverse charge VAT at the rate of 18% that they must bear.

This tax has a compounding impact on the cost of internet in Uganda because the ISPs pass over its incidence to the final consumer plus the other local taxes applicable on the sale and supply of internet in Uganda also due at the point of sell to the final customer.

3. Withholding tax on international payments

In addition to the reverse charge VAT at the rate of 18% imposed at the importation of internet connectivity services, service payments to foreign vendors for this internet are subject to withholding tax (“WHT”) at the rate of 5% unless there are applicable double tax treaties that may vary otherwise.

This must be deducted from the gross payment due to the foreign vendor. Though theoretically the vendor is expected to receive the agreed service payment less the WHT, it is not always necessarily the case in practice. It is common for foreign vendors to demand their fees net of local WHT meaning that the local customer in Uganda must gross up the net payment and bear this tax.

This pushes the incidence of this tax to the local customers further compounding the price of internet.

4. Reverse charge VAT

Given that internet is not locally available, it has to be procured from foreign vendors by the ISPs in what amounts to an importation of services. Any import of services that is not exempt from VAT such as internet is subject to VAT at the rate of 18%. The reverse charge or imported services VAT ends up being a cost to the ISP because it is unable to claim this output VAT as input VAT.

This ends up as a business cost ultimately pushed down to the final consumer via increased internet services charges.

5. Domestic excise duty

Unless used for educational and medical purposes which itself is difficult to fully delineate, the domestic usage of internet connectivity services attracts excise duty at the rate of 12%.

This tax is payable by the final customer.

6. Domestic withholding tax

Designated taxpayers must withhold tax at the rate of 6% on the remittance of internet service payments to the ISPs. This would not be a cost to the ISP as it is available for use as a credit against year-end corporation tax liability though it can create some cashflow constraints.

7. Corporation tax

The ISPs also pay corporation tax at the rate of 30% of their taxable profits. There is no issue with this and is consistent with how the other sectors of the economy are taxed.

8. Conclusion and scope for policy reform

To make internet more affordable in Uganda, it is imperative that the government reconsiders its tax policy in relation to the taxation of internet connectivity services. There is a multitude of taxes imposed along the internet business value chain that compounds the cost of internet to the final customer.

Uganda is a signatory to the International Telecommunication Convention (ITC) which if domesticated or replicated in domestic tax legislation, a significant part of the problem would be solved. The ITC Regulations namely Melbourne 1988 and Dubai 2012 provide that “Where, in accordance with the national law of a country, a fiscal tax is levied on collection charges for international telecommunication services, this tax shall normally be collected only in respect of international services billed to customers in that country, unless other arrangements are made to meet special circumstances.”

This would mean that internet at importation by the ISPs would not attract reverse charge VAT and withholding tax which presently significantly compound the cost of internet in Uganda.

The writers are with Cristal Advocates

Links

- 320 views

Join the conversation